Supply, Demand and the Way Through

For about a week now, most of us have been hunkered down in our little COVID caves under a “social isolation” directive. Some of the rest of you are under strict shelter-in-place orders.

Here’s the bottom line: We will get through this.

And not in a dystopian, I Am Legend kind of way, though if you’ve wandered the streets in South Lake Union or Times Square lately, it might feel like that. It is going to be a rough ride out of where we’re headed, but we’ll ride it out. And depending on how we decide to heal and repair, we could very likely be in a better and stronger position when this is over.

I want you to remember this, because what I’m going to say about what’s coming is scary and it will be easy to freak out or panic. I’m going to give an overview here of what I think our recovery might look like because I want you to be prepared. As prepared as anyone can be in a situation we’ve never seen that is evolving faster than we can absorb.

I will add that there are other schools of thought regarding where we are and the likely outcomes. Those predict a peak of virus spread in two months, and that economic damage will be due to market psychology, with stock markets recovering in the second half of 2020. While I don’t disagree entirely with this perspective, I do not share it. It’s possible the stock market will be on the upswing by year-end, but as you’ve heard me say a dozen times, the stock market is not the economy.

Let’s start by talking about where the economic part of the crisis began, and supply and demand.

SUPPLY

At the core of economics is the intersection of supply and demand. The economic impact of the public health crisis started with a shock to the supply of oil. If you control the supply of something people want, you have a lot of say about how much they’ll have to pay for it. Oil exporting nations have long used a cartel (a group of suppliers that restricts competition and agrees on how much to produce) to control the price of oil. OPEC (the Organization of Petroleum-Exporting Countries) was formed in the early 1960’s, and in 2016 was loosely expanded into “OPEC+” to include non-OPEC oil producers like Russia.

In early March, OPEC called an emergency summit to determine how to deal with the drop in the price of oil since the beginning of the year. China is a major market for oil, and with COVID-19 rampant in Wuhan, China had closed its borders and restricted movement in country. Its need for oil plummeted. OPEC agreed on production levels to limit supply (propping up the price) and asked the wider OPEC+ countries to comply. Russia rejected the agreement. Saudi Arabia countered by offering unexpected discounts to Europe, Asia, and the US. The tiff resulted in a free fall in oil prices, dropping 30%.

This was a supply shock.

DEMAND

Economies and markets are all connected, and the virus’ impact on economic activity contaminated financial markets. Markets reacted to the price war over oil, as well as growing concerns over the spread of the coronavirus, and together that morphed into the initial stock market declines early in the month.

I will add that there were politics at play as well. The US has placed economic sanctions on Russia, and some say Russia’s move was intended to hurt the US. Since we are now a major oil exporter, it did. Financial markets reacted, then absorbed what happened, said “that was fun,” and mostly we moved past it. Stock prices began to recover.

Fast forward a couple of weeks, and we’re at the end of third week of March. As COVID-19 spread from continent to continent, the response to slow the wave was to stop interacting. Whole cities and regions started to shut down worldwide. The initial supply shock was complicated by the underlying demand shock: As Wuhan restricted movement, its economy ground to a halt. Hard stop.

Repeat in Italy. In France. In Seattle, New York, San Francisco…

Economies experience expansions and contractions. That’s the nature of the business cycle. Typically they happen gradually, which gives business and governments time to react. The kind of hard stop in economic activity we are seeing now usually happens with natural disasters: hurricanes, earthquakes and such, and they are specific to a geographic region. But this one is worldwide. And man-made. Two quarters of negative economic growth is what defines a recession. With the sudden halt of economic activity everywhere in the course of a few weeks, we are now almost certainly in a global recession.

Remember what I said about not panicking. Keep reading.

THE CASCADE OF CRISES

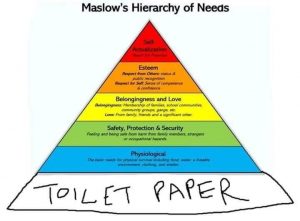

A couple of weeks ago, I emailed my mastermind group of fellow advisors about how as Washington state became the epicenter of the coronavirus in the US, for weeks we had been increasingly curtailing our activities. As a single woman and solo practitioner working mostly from home, my life outside work – lectures, art events, cafes and the like – is the way I stay sane and connected. It was a very weird thing to watch my world slowly grind to a halt. Now we’re all experiencing this contraction of activity – social as well as economic – as demand for everything (except apparently toilet paper) dries up.

The public health crisis becomes an economic one: gatherings are restricted and the ballet and symphony can’t hold their performances, losing their source of income. Restaurants and bars have to close, losing their source of income. Hairstylists and dentists, retail clerks and housekeepers are considered non-essential and ordered to stay home, losing their sources of income.

Together, the supply and demand shocks hitting at the same time gives us a global economic stall. China and the US and European economies are huge parts of a complicated inter-related system that suddenly gets shut down. If there’s a lesson in all this, it’s that we’re all connected.

The public health crisis creates an economic one, the economic crisis becomes a financial crisis, and we circle back around to the growing public health impact, which creates an unemployment crisis, which in turn exacerbates the economic crisis. And so the negative feedback loop can continue — unless we can counter the momentum. And we’re taking action to do that.

Hanging in there?

THE WAY THROUGH

In the short-term, we’re working to do what we can to protect the most vulnerable, in terms of physical health, and in terms of financial health. We want to make sure markets continue to function, even as they are under great stress, and the same for banks and businesses, so that the flow of funds in the economy – including the personal economy of your household – doesn’t dry up.

The life blood of an economic system is money. Cash. Money flows through our economic system through lots of different markets, like veins and arteries and capillaries. There are distinct markets for different types of debt – US Treasuries, mortgage loans, municipal and corporate bonds. So a lot of what you’re seeing in moves by our Federal Reserve and other central banks are actions to ensure that we don’t get what Mohamed El-Erian, Chief Economic Adviser at Allianz, calls a “reverse contamination”: the virus first infects the economy (via demand and supply shocks), which then infects financial markets (stock market declines), and if capital markets (access to cash) seize up, they can “reverse infect” the economy, making the situation worse. The Fed’s actions are to counter the negative feedback loop.

Over the last week, the Fed has deployed $700 billion in emergency lending programs to support the bond market. When the market for US Treasuries showed some strain, the Fed was there. When the commercial paper market (super short loans for companies) showed strain, the Fed stepped in. Municipal securities (borrowing by state and local governments) and corporate bond markets (borrowing by the private sector) continue to experience some stress, and the Fed is intervening. These are all good signs. Folks at the Fed are watching all parts of the financial system, and injecting help where it’s needed, to respond as our situation continues to evolve. Good monetary policy (action by the Fed) is the safety net to keep financial markets running smoothly in times of stress.

We are also seeing action from the federal government to help ease our way through this. Unemployment expansion, concessions around the costs for testing and treatment, are a start. The economic stimulus we are awaiting from Congress should address the liquidity crisis (cash) being faced by millions of households. Whether that comes as a check to you, or via helicopters full of cash, it behooves us to be generous with this aid now, to keep as many afloat as possible, so that we all find the way back to normal economic activity faster. We learned this lesson in the Financial Crisis. It took 10 years to recover from the hit to jobs after that crisis.

What we need to see next is more action from Congress on economic stimulus, and that our health care system is starting to catch up to the virus. As I write this, Congress has not yet agreed on an economic stimulus package (the hold-up is over transparency of a $450 billion spend). We should see a lot more cases of COVID-19 as more testing is done. On Thursday, we’ll have a jobs report that is expected to show TEN TIMES the number of normal weekly unemployment claims.

If and when you see these numbers, do what you can to take in the data without the bold type or hyperbole that will inevitably surround it. The data, at a minimum, is likely to get worse before it gets better.

THE WAY OUT

For the longer term, we will need to invest big time in a recovery, and it’s not going to be a straight and easy path. El-Erian put it this way: It’s not about a destination, it’s about a very bumpy journey.

We are going to emerge from our isolation into an economic world that will not look the same. Even by flattening the curve, the impact of the coronavirus will roll out over a period a time, before we can all get back to work. You cannot just flip a switch and have everything go back to normal. Thousands of people will be recovering from COVID19, millions will be dealing with job loss, and many small businesses as well as large companies may not make it.

Despite the huge humanitarian toll and economic cost this crisis takes, it does also present an opportunity for us to decide how we will go forward.

• We will need to engage fiscal stimulus to find our way forward. This means government spending to stimulate the economy; in this case, a defibrillator to jump-start the economy back to life. We lost a huge opportunity after the Financial Crisis to use public works programs to get people back to work, to pay them for their for their talent and efforts, and have renewed infrastructure to show for it.

• This stimulus also means aid to small business. Liquidity among small business is especially acute; restaurants in particular are very narrow margin businesses (revenues just slightly higher than operating expenses), most small businesses don’t have much of a cash cushion to keep them going while waiting out a downturn. Neel Kashkari, head of the Federal Reserve Bank of Minneapolis, suggests forgivable loans to help here, loans to small business that are forgiven over a period of a few years if the business retains its employees.

• We may need to adjust to portfolios that don’t produce the same level of earnings, particularly dividends, at least in the short to intermediate term, as a greater portion of profits go to workers. In the long-term, this should benefit all by creating greater resiliency in our economy, and in the economic resiliency of – and demand from – each of us.

• We can finally uncouple health care coverage from employment. This uncoupling has nothing to do with your doctors, but with insurance. The trifecta of losing your job, then your health coverage, then getting sick gets addressed.

We will survive this virus and the current state of financial markets, but both will leave their marks. The question is, will we learn from them, and will we change to make us better prepared next time? Because this WILL happen again.

WHAT YOU CAN DO

Because we will get through this, taking care of yourself is more important than ever. That means social distancing, respecting shelter-in-place orders and a six-foot bubble around others. That means stocking up with enough so that you don’t have to be at a store more than necessary, but not so much that your neighbors have nothing. It also means self-care and compassion. Eat well, drink moderately or not at all, do the things that bring you comfort: music, cooking, reading, exercise within our new protocols.

While contact with others comes with new dangers, social isolation presents risks, too. Connect with others directly when you can – by phone, FaceTime, Zoom, email. We ‘re all in this together, and it helps to know you’re not alone. (Even though, right now, in your house, you might be actually be… alone.)

- Support your local business: take-out, gift cards, pre-pay for future services, don’t request a refund on tickets to events that have been cancelled if it helps the organization keep going, continue to pay your housekeeper even if they aren’t coming to your house

- Focus on “regret minimization” rather than making no mistakes. We are managing through a volatile time with great uncertainty, and we are going to make mistakes. You need to make sure you can afford the mistakes you make.

- Duct tape your younger household members to the wall so they stay home and stay six feet away from each other. Teenagers and twenty-somethings have always thought they were invincible. They are not, and not from COVID-19.

- Adult household members who aren’t “that old” and want to eschew the advised precautions? This time it’s not ageism, it’s really a thing. Try persuading them that they need to avoid seeing their grandkids now so they can see them at their college graduation.

- Not in a high risk category? Consider giving blood. Blood banks have been hit hard with big employers cancelling their blood drives. And it’s a chance for you to get out of the house.

- Take a deep breath. Of all things to be grateful to be able to do now, that’s one.

- Do your best to cope. I use humor, so I’ll leave you with something silly below, courtesy of Jacques Pépin.

The bottom line is that we will get through this. I can’t do better than Churchill on managing through a difficult time: When you’re going through Hell, keep going.

And one more thing: Wash your hands.