Planning in One Page

Colleague and sketch guy extraordinaire, Carl Richards, has a new book called The One-Page Financial Plan. My work is all about organizing, simplifying, and getting clarity around what really matters for you, and a one-page plan sounded awesome. As I often do, I test-drove this process myself and here’s what my One-Page Plan looks like:

To be able to take care of myself:

1. Own my home

2. Financial freedom at 70

3. Ability to participate in the communities I love

What you’ll see right away is that the plan is very focused, and simple. But for any of you who have practiced yoga or tried meditation, steadying the wiggly body or calming the monkey mind is harder than it looks.

But this is exactly what you must do to have a plan that works: You must get to the “why” of what you’re doing. I call what I do “values-based” financial planning, and at its core it’s about what you value, what is important to you. The “why” will become your litmus test for financial decision-making.

The “Why”

Carl’s one-page plan starts where I also start the planning process, with the “why.” The Why is your financial mission. His question is: Why is money important to you?

To have a secure retirement?

To take care of your family?

To die with the most toys?

The Why is totally internally-driven. If you are looking for external validation, your “why” will always fail, because you’re not directing it. When it’s externally-driven, you’re looking to the outside for validation, and you won’t feel a sense of calm when you answer the question. When you answer truly, you relax, you feel a relief from anxiety. You’ve answered the question.

What Gets in the Way of The Why

Part of getting to The Why is digging into what money means to you. My financial mission is to be able to take care of myself. My process looked like this:

Money is important to me because I want to be financially secure.

Because I want to be able to take care of myself.

Because no one else will be there to do it.

In those three sentences, I got to one of my core values: self-sufficiency. I came from a working class family. My parents bought their first house on the GI Bill, my dad went to school and worked part-time, and money was a struggle. I worked my way through college, and graduate school. There was a lot of messaging in my early life around my family not having any support outside the four of us — my parents, brother and me — and how we could only rely on ourselves.

Being able to take care of myself financially – pay my bills, never get in over my head, take educated risks but don’t bet the farm, have a little money socked away, a few staples in the pantry always– is at the core of how I run my financial life.

For you, it might be thinking you “should” have a house, but you’re really fine renting and would rather put your savings into a business idea. It might be feeling you deserve a certain standard of living, when the fear is really not living up to someone else’s (or your) standards, of not being as good as your peers. Only you can know why money is important in your life.

The “What”

Once you figure out why you’re working hard and saving – or spending your nest egg in a certain way – then you can get more specific about the actions you need to be taking to work towards these goals. What Carl notes – and embraces – is the certainty of change. Don’t wait around for the perfect answer or the “right” decision. Good planning is a lot like living your life fully: you start where you are, with what you can do today, and do it. You have to translate The Why into actionable goals. You need to list everything you want to do or have, then prioritize in terms of how “The What” supports the Why.

To live up to my Why, I want to own my own home, save enough to be financially independent at age 70, and participate in the communities I love. Taking care of myself doesn’t mean spending all my time at the office, it also means having a good life today, and so I’ve included how I’ll spend my time in addition to what I’m doing with my money. Your plan is about you and building a meaningful life.

The What is the top three specific things that you need to do to fulfill your financial mission. You’ll note that not all these goals necessarily require financial resources: two of the communities I love involve dogs and books, and I’ve volunteered in animal shelters, libraries and school reading programs. What is your What? What are the three goals you’ll work on now?

Putting Your Why and What into Action

Once you have your Why, you have a measure against which you can evaluate the financial decisions you face. When you wonder how to spend your money or how to save, ask yourself, is this action supporting your Why? For me, I ask “Will this action enhance my ability to take care of myself?” Then test the decision about which of your three top goals it’s advancing.

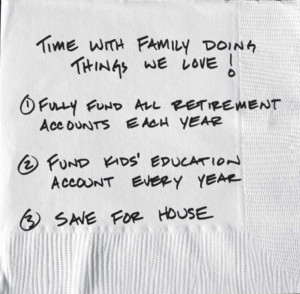

That’s it. Write your Why and your What on a post-it or an index card (Carl wrote his, shown here, on a napkin with a Sharpie). Put it on your mirror, keep a copy in your wallet. This isn’t about other people telling you what to do, this is a talisman of your creation, your money mantra to keep you centered and on track to get what you really want out of this life.

That’s it. Write your Why and your What on a post-it or an index card (Carl wrote his, shown here, on a napkin with a Sharpie). Put it on your mirror, keep a copy in your wallet. This isn’t about other people telling you what to do, this is a talisman of your creation, your money mantra to keep you centered and on track to get what you really want out of this life.

Get out your Sharpie and get to work!